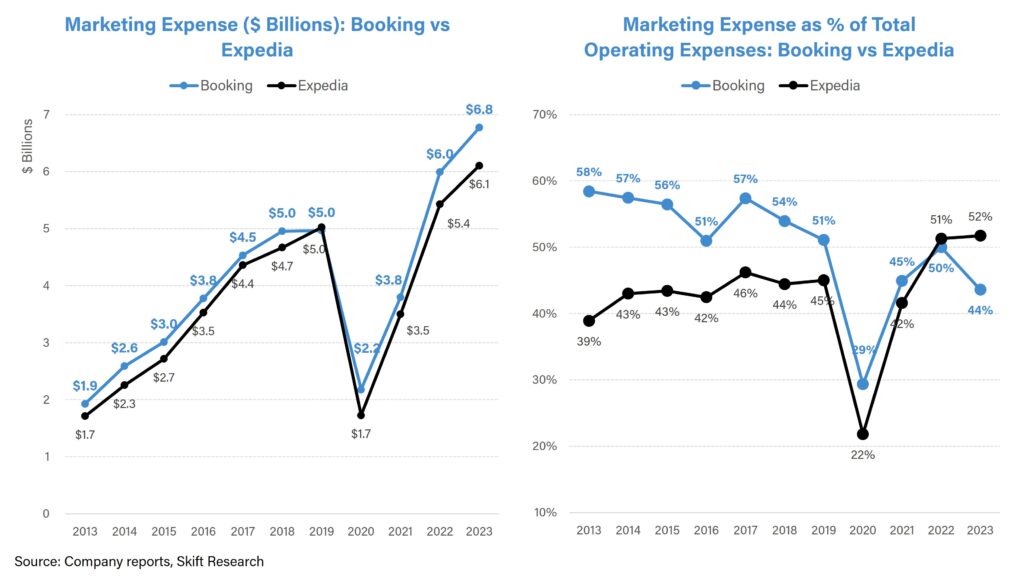

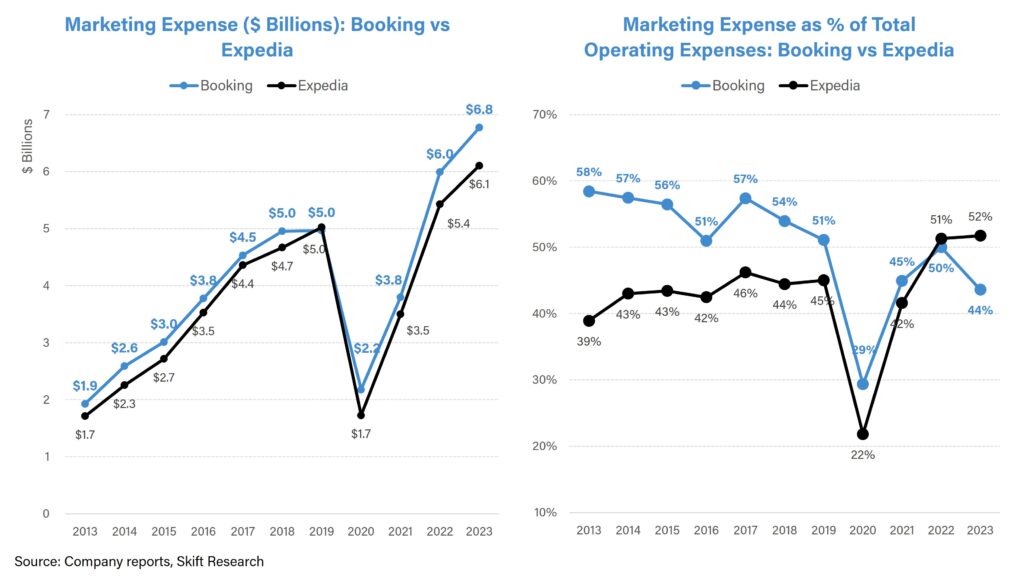

Booking and Expedia spend a ton on marketing: Nearly $13 billion combined in 2023, up from $10 billion in 2019. And it’s the largest expense for both companies, accounting for roughly half of their total operating expenses.

But from there, some key differences emerge, according to the latest analysis from Skift Research.

1. Who Spends More on Marketing?

For one thing, marketing is gaining in prominence for Expedia (up to 52% of operating expenses in 2023, from 45% in 2019) and declining for Booking (44% vs. 51%.)

2. Who Spends Smarter?

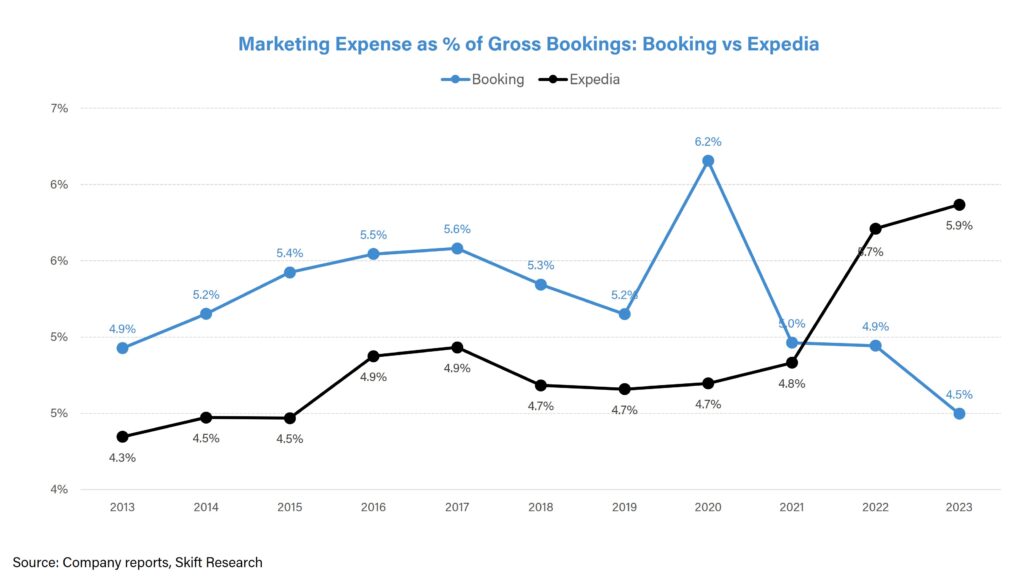

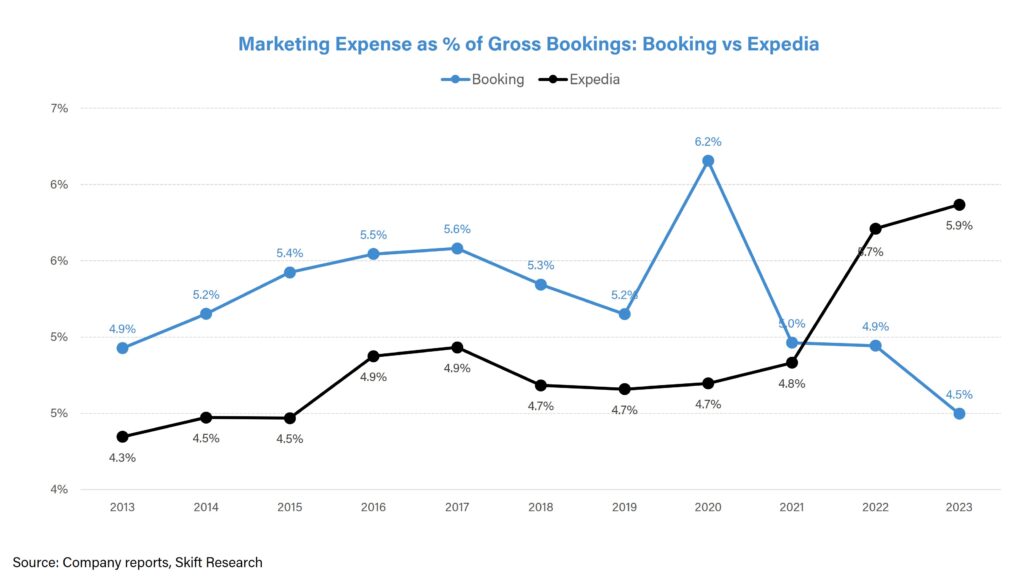

Another important difference is “marketing efficiency” – how much they need to spend to drive bookings. Expedia was less efficient: It spent nearly 6% of its gross bookings on marketing in 2023, versus only 4.5% at Booking.

Some of this can be attributed to the recent growth of Expedia’s B2B segment because Expedia treats the commissions it pays to its partners as a direct marketing expense. These commissions tend to be higher as a percentage of revenue than marketing expenses from the consumer business. Expedia is also spending more marketing dollars on its vacation rental brand Vrbo and in international markets.

Booking is trying to clamp down on those costs. “Another thing we saw that we don’t talk a lot about it – I won’t get too specific – but we saw ourselves using money that we thought was producing a good ROI, and we turned out, it really wasn’t,” said Booking Holdings CEO Glenn Fogel on a recent call discussing second-quarter earnings. “And we shut some of these things down.” Booking is also seeing its direct bookings channel grow faster than paid marketing channels.

3. Pivot to the Merchant Model

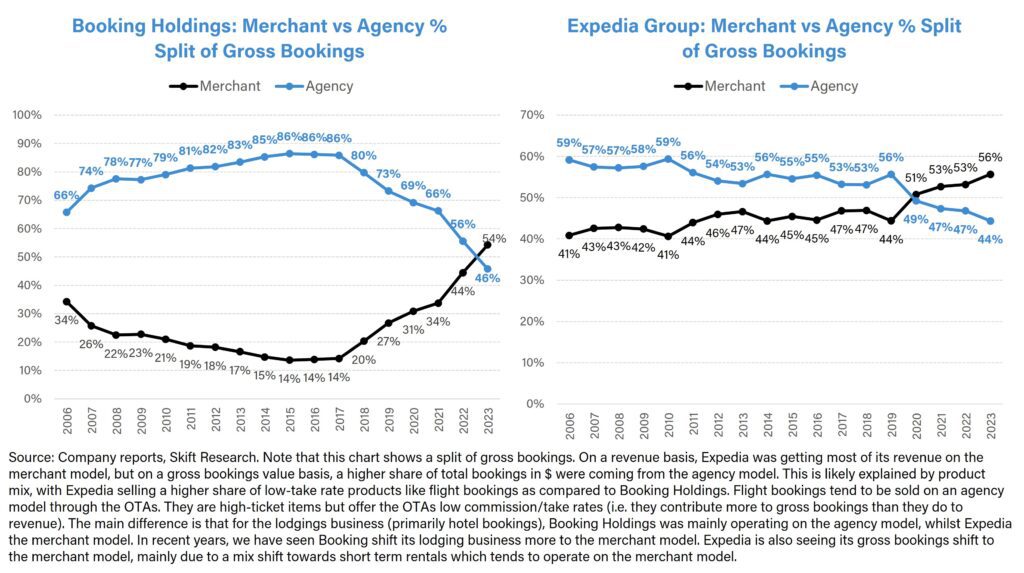

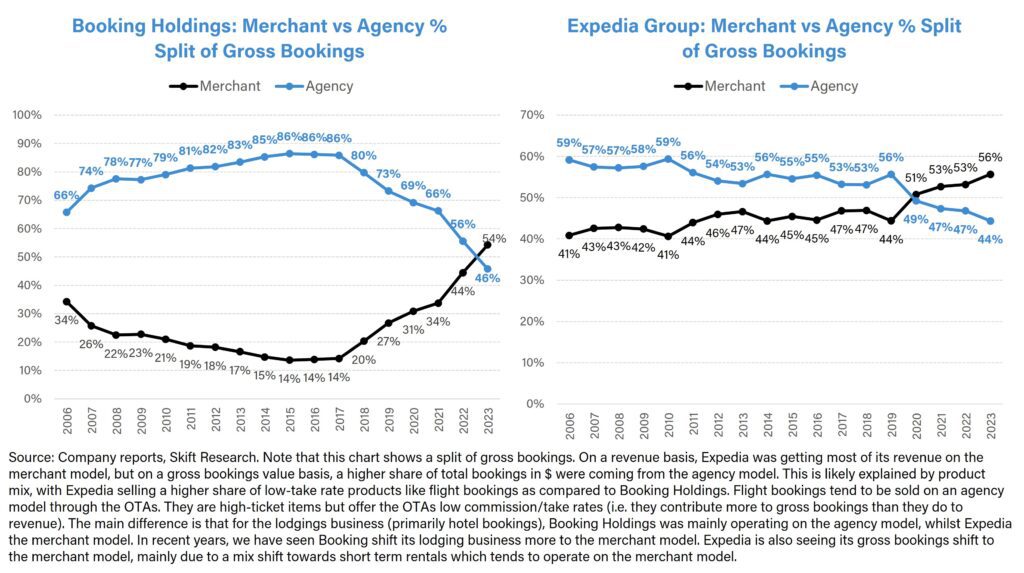

Though both companies sourced their gross bookings mainly on an agency business model in the past, they have moved in recent years to the merchant model.

Under the agency model, hotels list and set their own prices, collect payments from guests, and pay Booking and Expedia a set commission.

Under the merchant model, the OTAs negotiate a rate with hotels upfront, and then set prices and collect payments from guests. This model has a number of advantages: The OTAs have greater control over pricing strategy (such as discounting and merchandising); it allows them to bundle services like flights and car rentals (and sell the ‘connected trip’); and they can offer in-house payment services.

4. More Competition, More Discounting

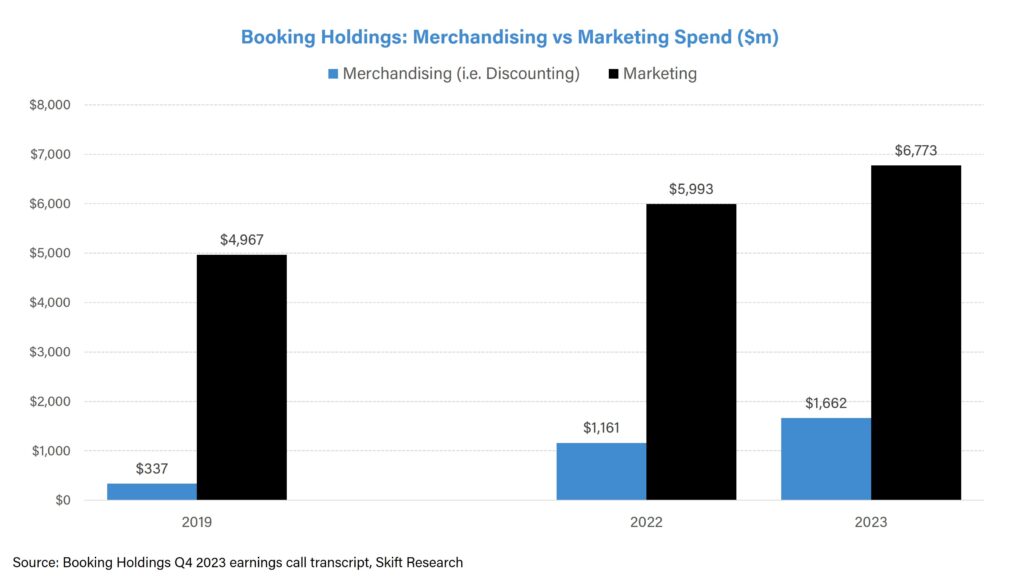

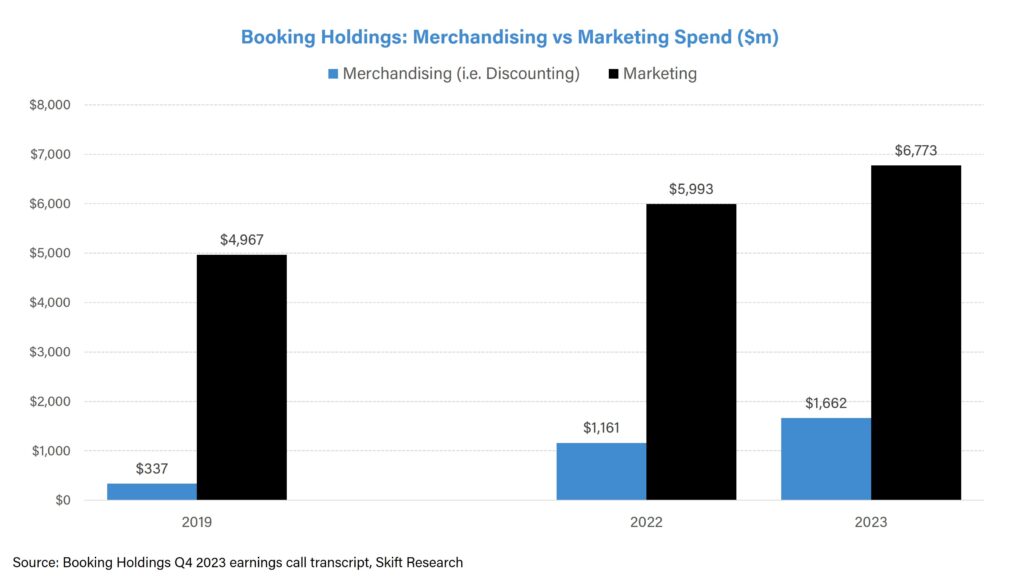

Both companies are now leaning into merchandising (such as price discounting, ancillary upsells and bundling) as an alternative to direct marketing.

In 2023, Booking spent nearly $1.7 billion on merchandising efforts (or 1.1% of total gross bookings), compared to only $337 million in 2019 (or 0.3% of gross bookings). That represents a nearly 5x increase in expenditure on merchandising since 2019. As a comparison, marketing spend increased 1.4x from $5 billion in 2019 to $6.8 billion in 2023.

We can argue that the need for merchandising (primarily the funding of discounts out of their own pocket) is a sign of a more competitive environment for two major OTAs that haven’t had to rely on such pricing tactics before.

These discounts have a direct impact on take rates. In its earnings call for the third quarter of 2022, Booking said merchandising impacted take rates by about 1% in 2022, vs about 0.5% in 2019. Compare that to 2008 and 2009, when hotels were struggling and they were the ones offering discounts to OTAs.

As we have written before in The Past, Present, and Future of Online Travel, Booking and Expedia, once riding the wave of easy double-digit growth are today facing slower growth, stiffer competition, and increased pressure on profit margins.

Expedia’s former CEO Peter Kern acknowledged as much at the Skift Global Forum in 2022: “The easy money, where we’ll just be online and we’ll just collect everybody who’s decided to book online has certainly lessened over time”.

Booking’s CFO also pointed to the tough environment in the fourth quarter of 2022 earnings call: “These are very competitive markets. There are many players in the market. I think people realize it’s not just the OTAs, there are meta players, there are hotel players, there are chains, you name it, a lot of people are bidding in these marketplaces. So I think it just remains competitive.”

5. Who Spends Most on Google?

Google is a major recipient of Booking and Expedia’s marketing budgets.

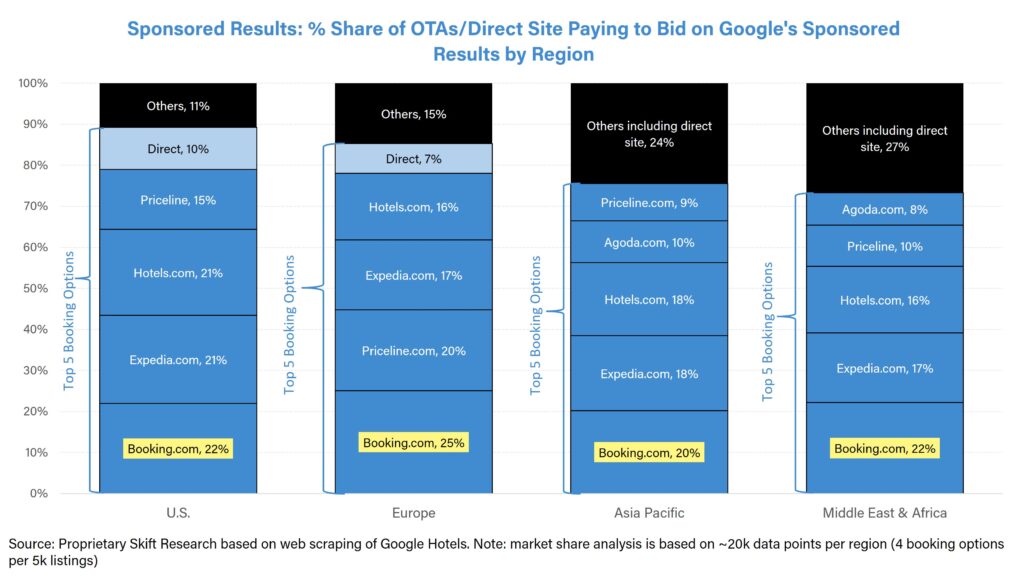

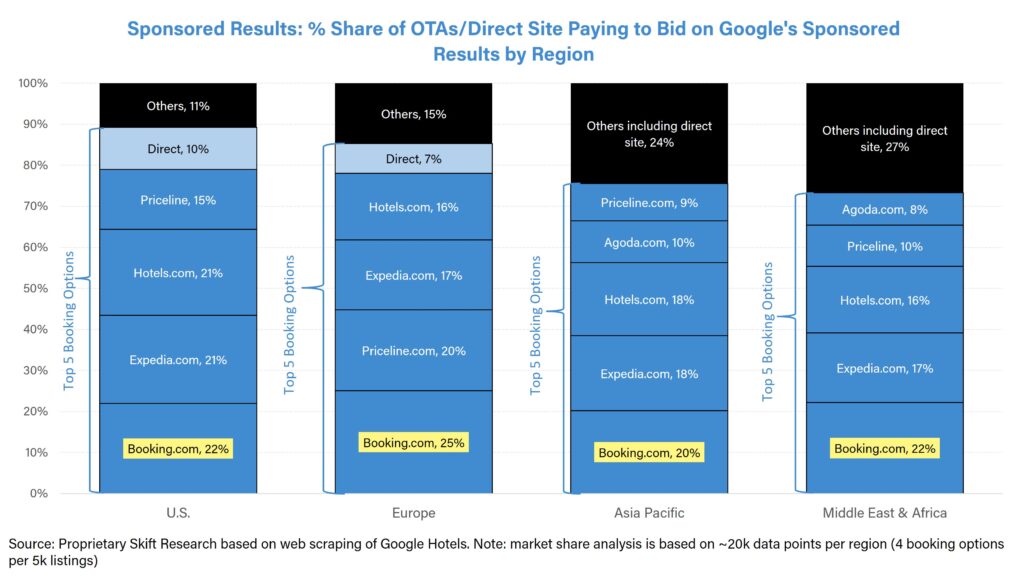

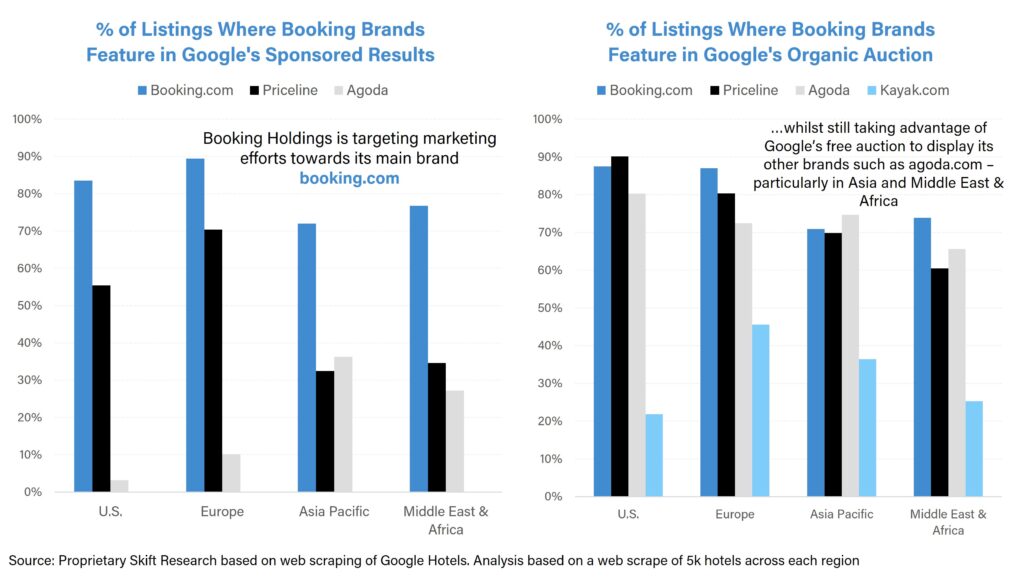

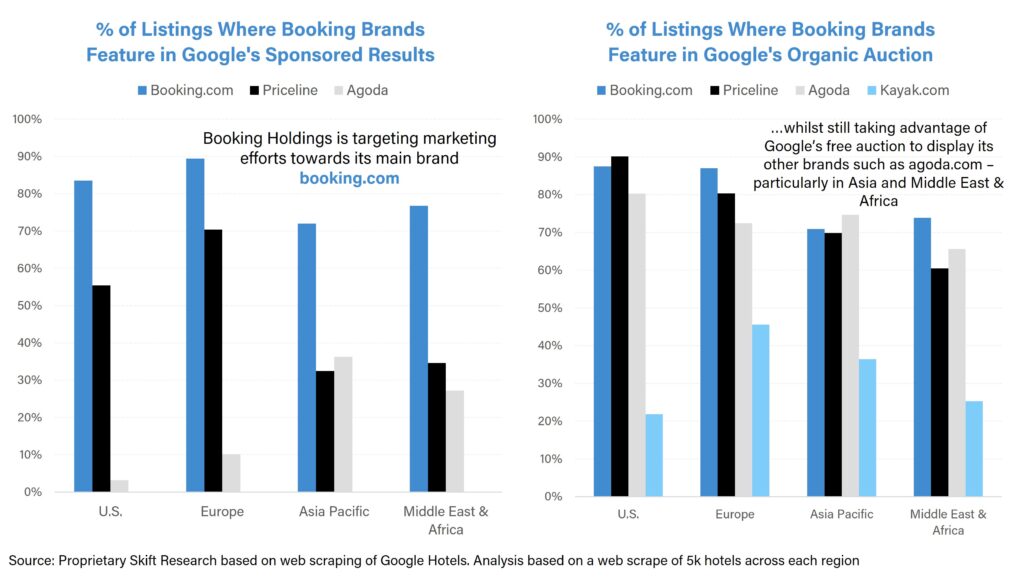

Earlier this year, Skift Research ran a web-scraping exercise of Google Hotels, which involved web-scraping more than 20,000 hotel listings across the U.S., Europe, Asia Pacific and Middle East & Africa to analyze which OTAs and direct sites are bidding for bookings on Google.

Booking.com is the dominating presence across Google’s sponsored results, paying to appear most often out of any other OTA in every region. Of the top 5 most visible options in every region, Booking and Expedia through their sub brands (such as Booking’s Priceline.com and Agoda.com and Expedia’s Hotels.com) have outbid any local players.

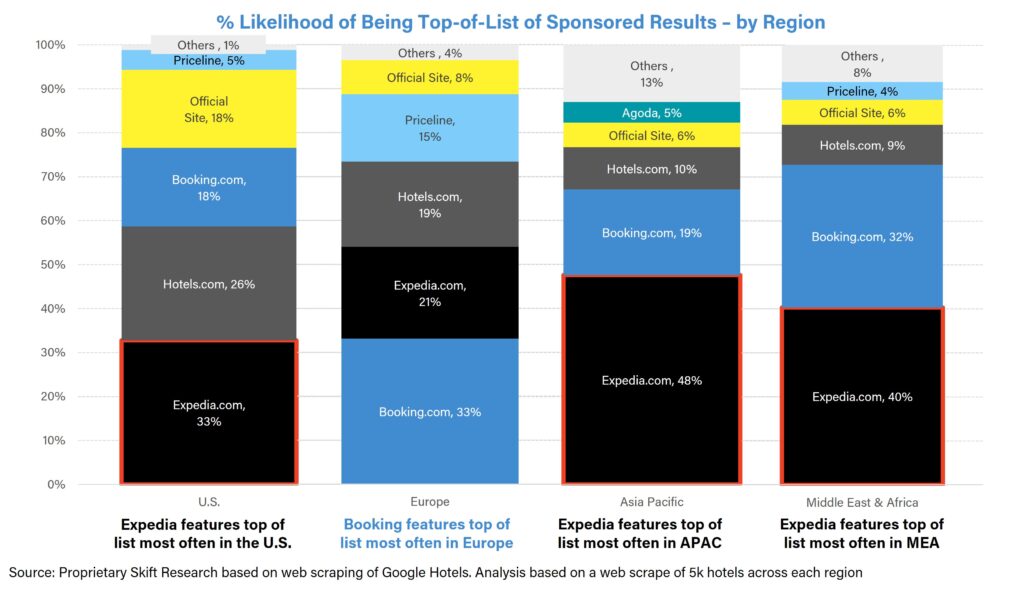

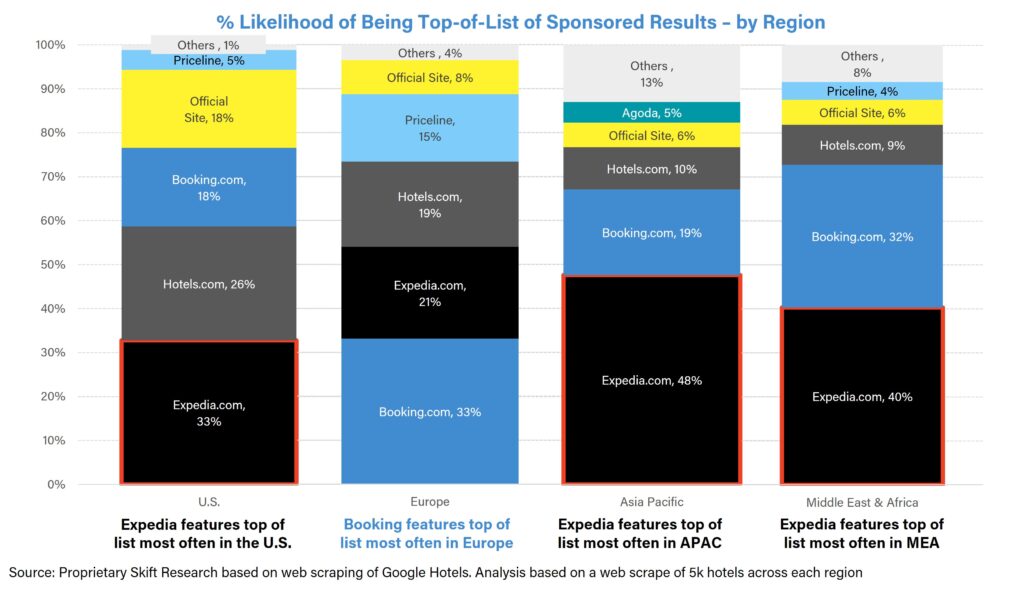

However, we can also see that Expedia.com is purposefully investing ad dollars to be the top-of-the-list option in a clear bid to outcompete Booking.com, particularly in regions such as Asia Pacific and Middle East & Africa.

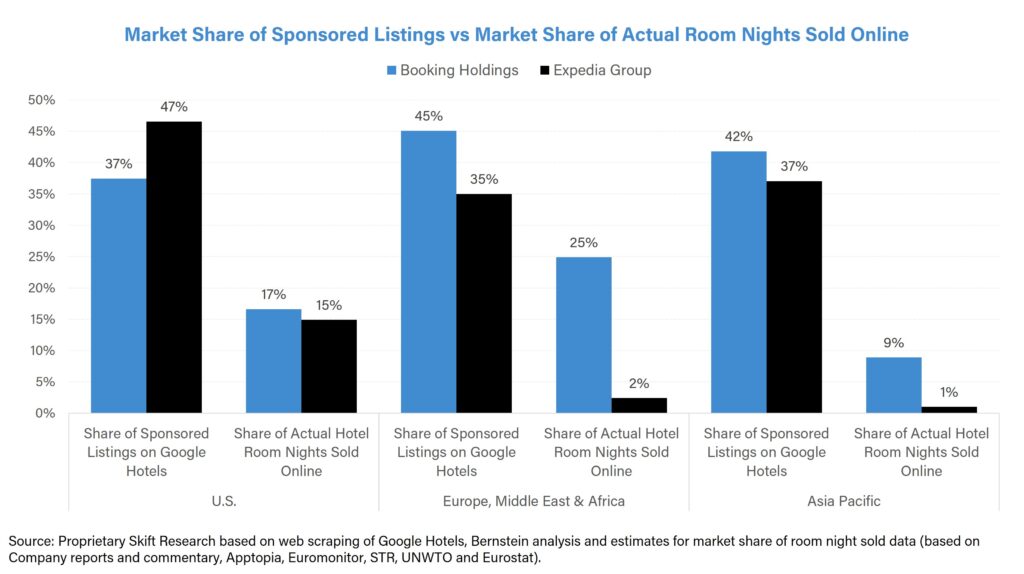

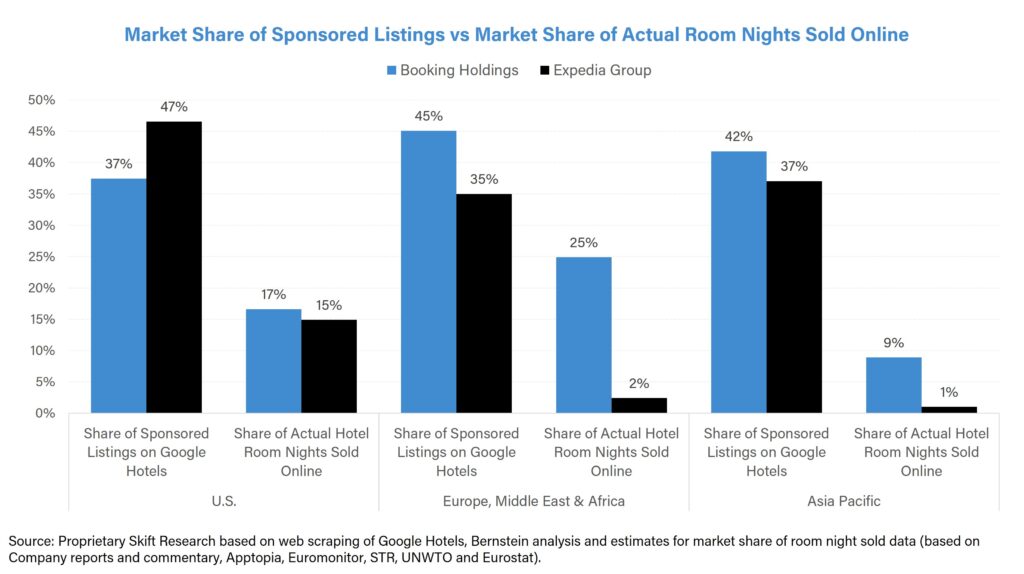

Our analysis also showed that Booking Holdings has a higher return on ad spend from Google’s sponsored listings than Expedia in every region.

Booking and Expedia collectively have about 80-85% share of Google’s sponsored results in every region , going to show the level of advertisement spend they are investing into Google. Generally, compared to Expedia, Booking needs to spend less on marketing to drive a higher share of actual rooms sold online.

We can attempt to quantify the return on ad spend through Google’s sponsored results by considering the following calculation: market share of actual hotel room nights sold online divided by market share of sponsored results.

As shown in the chart below, we can see that Booking Holdings is generally more efficient than Expedia Group in converting spend on sponsored results to actual bookings. By region, we can see that Booking and Expedia have the highest marketing efficiency in the U.S. and in Europe vs in Asia Pacific.

Clearly Booking is seeing greater marketing efficiency than Expedia, but also benefits from having a more global reach with greater brand awareness. Expedia is much more focused on the U.S.

6. Marketing spend focused on core brands

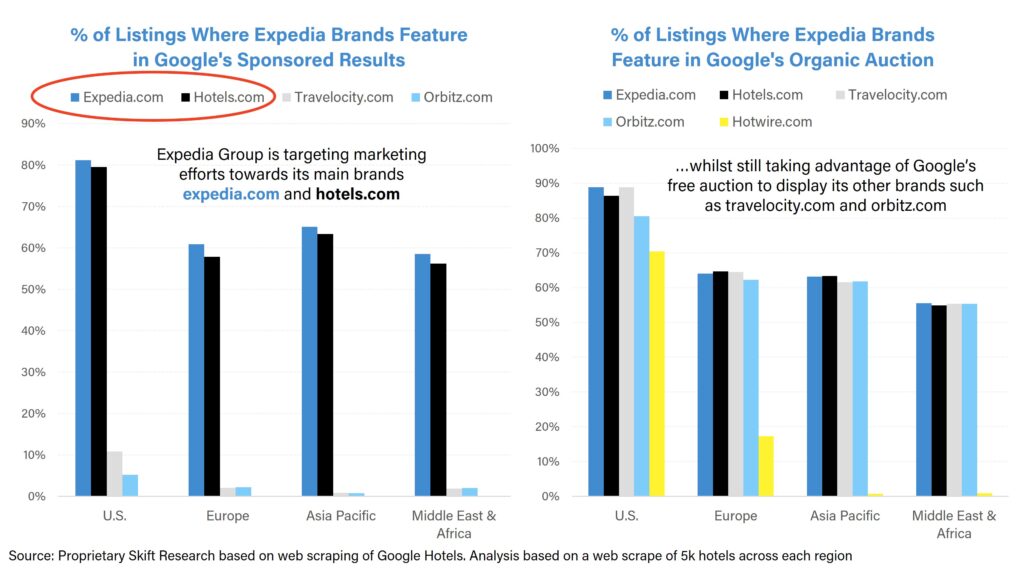

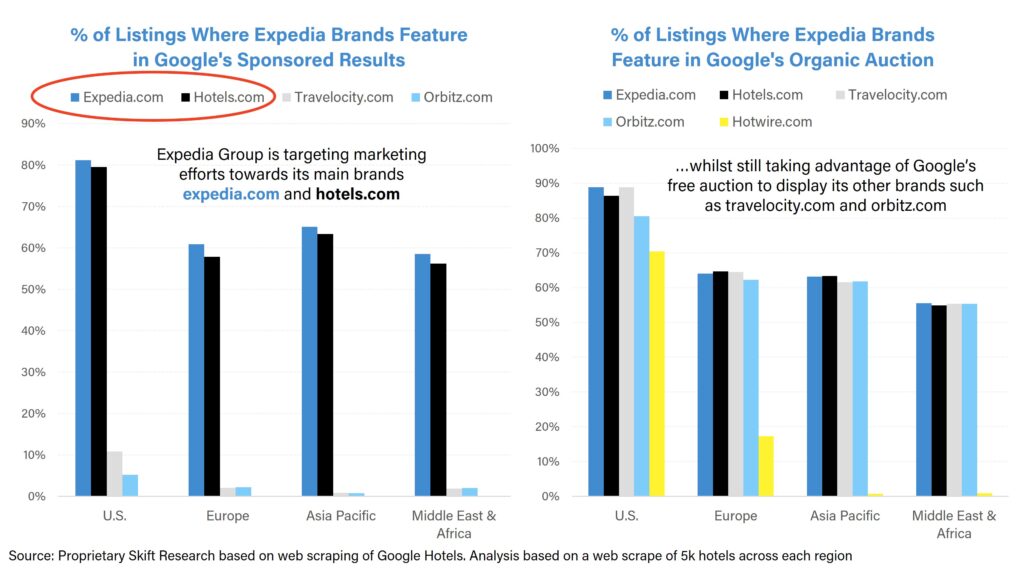

Our analysis also showed that Expedia and Booking are focusing marketing efforts on their core brands. In recent years, Expedia has focused on its key brands Expedia.com and Hotels.com (and Vrbo.com in its vacation rental part of the business), whilst de-prioritizing smaller sites such as Travelocity.com and Orbitz.com (see Expedia’s 3 Core Brands, Explained).

The chart below proves that in every region Expedia’s marketing efforts on Google’s sponsored results are being targeted towards its main brands expedia.com and hotels.com. Smaller brands such as orbitz.com and travelocity.com hardly feature on sponsored results and brands such as hotwire.com did not appear even once in our web-scraping database. This is not to say that Expedia isn’t taking advantage of Google’s free organic search, with all its sub-brands featuring in the organic results.

At Expedia’s Q4 2023 earnings, the then CEO Peter Kern commented that since 2020, “we rationalized investments in over 20 brands to 3 or fewer in every region. We eliminated dependency on 76 different agencies around the globe and instead built an entire full-service marketing, creative and media-buying team internally.

We consolidated all performance marketing into one group with unified data and tools, allowing us to optimize across brands and bring programmatic approaches to everything we do in metasearch, social, SEO and everywhere else”.

For Booking Holdings, we see a similar trend, with marketing efforts tied predominantly to its eponymous booking.com brand, whilst still taking advantage of Google’s free auction to display other sub-brands such as agoda.com – particularly in Asia and the Middle East.

This article uses excerpts from three recent pieces of Skift Research:

- Booking Vs. Expedia: A 50 Chart Factbook

- The Past, Present, and Future of Online Travel

- A Deep Dive into Google Travel Part III: Hotel Distribution From East to West

Our most recently published report Booking Vs. Expedia: A 50 Chart Factbook provides a concise 50-chart factbook comparing the key financial metrics and performance indicators of the two major global OTAs: Booking Holdings and Expedia Group. We analyze segment mix by geography, global market share, EBITDA margins, take rates, marketing expenses, and valuation, amongst others.

What You’ll Learn From This Report

- Company Overview: Brand overview, Timelines by company, Mix by geography, Supply mix, Global market share

- Key Performance Indicators: Gross Bookings, Revenue, Take Rate, EBITDA & margins, Room nights & ADR growth, Operating Expenses

- Marketing: Marketing efficiency, Share and ranking of Google’s sponsored results by region

- Growth Outlook: 5-year forecast on revenue growth, EBITDA growth, EBITDA margin

- Share Price Performance & Valuation: Stock price vs Skift Travel-200 Index, Earnings per Share, EV/EBITDA Valuation, Free Cash Flow

This is the latest in a series of research reports, analyst sessions, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision-maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

Subscribe now to Skift Research Reports

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report à la carte at a higher price.